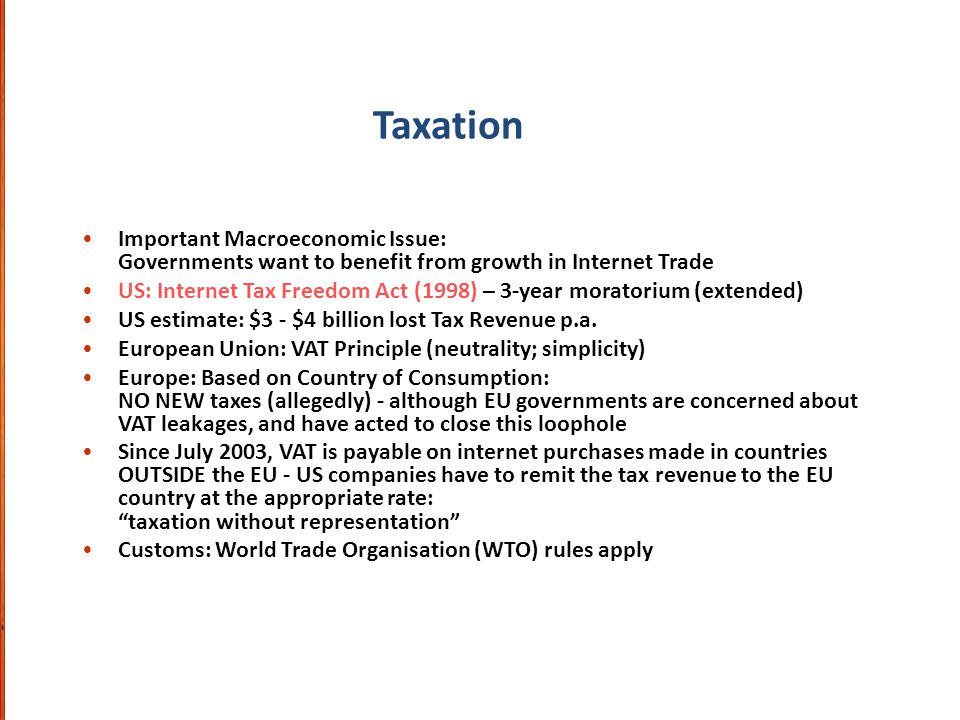

internet tax freedom act 1998

The Act bans federal state and local governments from taxing Internet access and from imposing discriminatory measures such as bit taxes bandwidth taxes and. Committee on the Judiciary 1998 US.

Ethical Legal And Public Policy Issues In E Business Ppt Download

The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL.

. This Act may be cited as the Internet Tax Freedom Act of 1998. Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus. 3529 including cost estimate of the Congressional Budget Office represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library.

The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL. The Internet Tax Freedom Act Amendments Act of 2007 PL. 1 taxes on Internet access.

MORATORIUM ON CERTAIN TAXES. The Internet Tax Freedom Act was signed into a US. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

The law bars federal state and local governments from taxing Internet access and from imposing discriminatory Internet-only taxes su. Senate passes Internet Tax Freedom Act. According to the new federal legislation the definition of Internet access includes.

Internet Tax Freedom Act of 1998 - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting to collect taxes on Internet access bit taxes or multiple or discriminatory taxes on electronic commerce with exceptions for. To establish a national policy against State and local interference with interstate commerce on the Internet or online services and to excise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would interfere with the free flow of commerce via the Internet. A AMENDMENT- Title 4 of the United States Code is amended by adding at the end the following.

3529 including cost estimate of the Congressional Budget Office represents a specific individual material embodiment of a distinct intellectual or artistic creation found in University of Missouri Libraries. 110-108 extended the Internet tax moratorium and the original grandfather clause through November 1 2014. Report to accompany HR.

Advisory commission on electronic commerce. 442 the Internet Tax Freedom Act. The act made permanent a temporary moratorium on such taxes that has been in placethanks to multiple short-term extensionssince the Internet Tax Freedom Act of 1998 ITFA.

The Internet Tax Freedom Act of 1998 ITFA. Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop charging those taxes beginning. The Resource Internet Tax Freedom Act of 1998 Title IX of Omnibus Consolidated and Emergency Supplemental Approbations Act of 1999.

The item Internet Tax Freedom Act of 1998. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. Law on 21 October 1998 in order to promote and preserve the commercial educational and informational potential of the Internet.

Internet Tax Freedom Act of 1998 Title IX of Omnibus Consolidated and Emergency Supplemental Approbations Act of 1999. 105-277 the Omnibus Appropriations Act of 1998 reproduced below establishes the Advisory Commission on Electronic Commerce. Internet Tax Freedom Act of 1998 Title XI of the Omnibus Appropriations Act of 1998 Pub.

Internet Tax Freedom Act - Title I. The Act placed a three-year moratorium on any new taxes on Internet access fees and prohibited multiple and discriminatory taxes on electronic commerce. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales.

The Internet Tax Freedom Act of 1998 ITFA. By Nancy Weil IDG -- The US. 105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet.

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new. CHAPTER 6--MORATORIUM ON CERTAIN TAXES Sec. The item Internet Tax Freedom Act of 1998.

Resource Information The item. The Congressional Budget Office has prepared the enclosed cost estimate and mandates statement for S. 1 Internet access taxes imposed under.

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce. The bill contains an intergovernmental mandate as defined in the Unfunded Mandates. The Internet Tax Freedom Act ITFA was enacted in 1998 to delay any special taxation of access to the Internet as advocates feared that excessive or burdensome taxation would harm the growth and.

Report to accompany HR. Notably the new act phases out a grandfather clause that has protected a handful of states Texas is among them allowing those states to tax Internet. John McCain Chairman Committee on Commerce Science and Transportation US.

Jun 17 1998. The Act also established the Advisory Commission on Electronic Commerce. Senate voted Thursday 96 to 2 to approve a bill that places a prohibition on.

October 9 1998 Web posted at 1125 AM EDT. Internet Tax Freedom Act of 1998 by United States. The Internet Tax Freedom Act of 1998 enacted a moratorium on the imposition of state and local taxes on Internet access.

Working with allies in the Senate NLC and other state and local government public interest groups as well as the E-Fairness Coalition and the National Federation of Retailers came close to finalizing a draft consensus bill to amend the Internet Tax Freedom Act of 1998 ITFA before the October 21 deadline for the moratorium on Internet taxes imposed by this statute. Internet Tax Freedom Act - Title I. It was extended by the Internet Tax Nondiscrimination Act and this act extends it again through November 1 2014.

Streaming And Franchise Fees Implications For Communications Infrastructure Troutman Pepper

California Tax Policy And The Internet

What Is The Internet Tax Freedom Act Howstuffworks

California Tax Policy And The Internet

Is A Global Internet Tax Coming In 2021 The Hill

California Tax Policy And The Internet

Michael Mazerov Center On Budget And Policy Priorities

What Is The Internet Tax Freedom Act Howstuffworks

What Is The Internet Tax Freedom Act Howstuffworks

Controversial Internet Tax Freedom Act Becomes Permanent July 1

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

What Is The Internet Tax Freedom Act Howstuffworks

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute